Loan Statute Of Limitations By State . The rules can vary greatly state to state. In others, it’s up to 10. in some states, the statute of limitations for credit card debt is three years. in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. 52 rows the federal trade commission notes that if you make a payment or agree to payment. if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old.

from www.creditrepair.com

in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. in some states, the statute of limitations for credit card debt is three years. if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. 52 rows the federal trade commission notes that if you make a payment or agree to payment. a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. The rules can vary greatly state to state. In others, it’s up to 10.

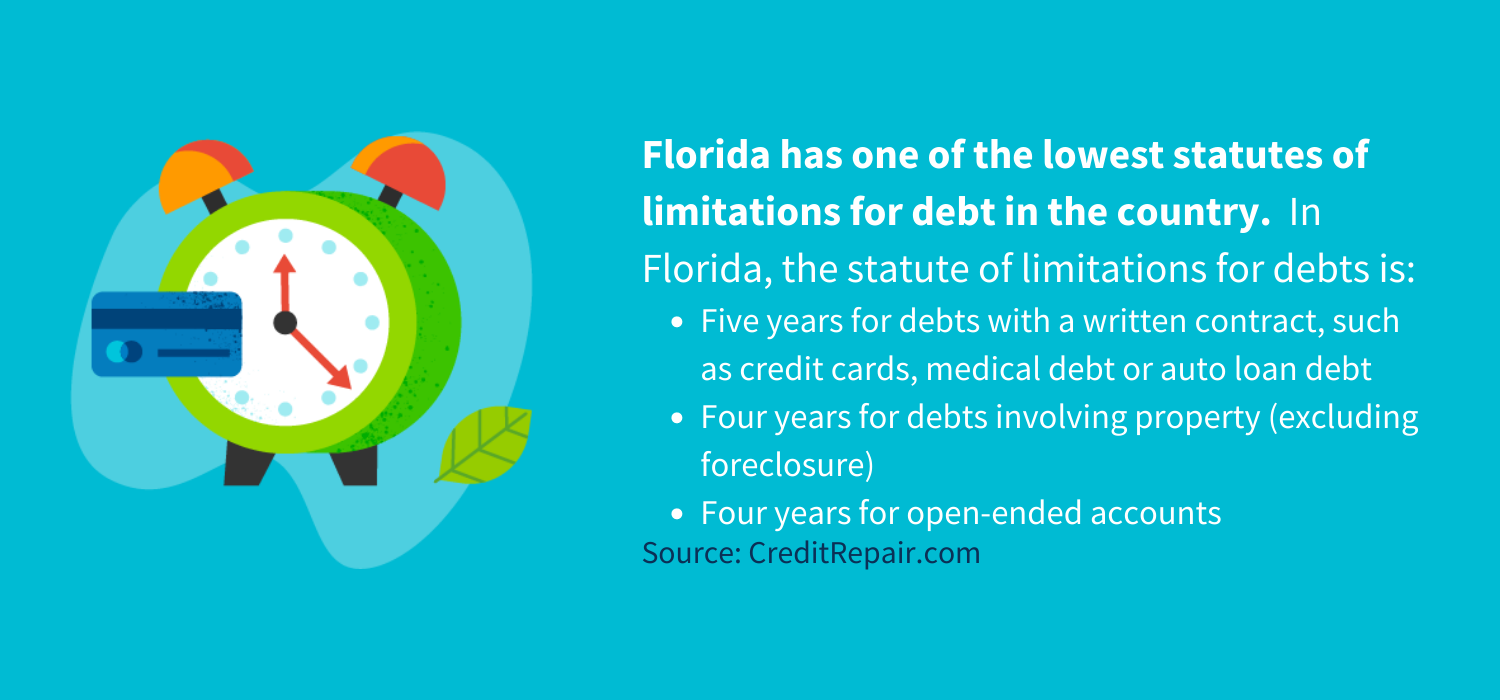

What is the Florida statute of limitations on debt and collection laws

Loan Statute Of Limitations By State in some states, the statute of limitations for credit card debt is three years. In others, it’s up to 10. The rules can vary greatly state to state. in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. in some states, the statute of limitations for credit card debt is three years. a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. 52 rows the federal trade commission notes that if you make a payment or agree to payment.

From www.creditinfocenter.com

StatebyState Guide to the Statute of Limitations on Debt Loan Statute Of Limitations By State if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. 52 rows the federal trade commission notes that if you make a payment or agree to payment. in some states, the statute of limitations for credit card debt is three years. in. Loan Statute Of Limitations By State.

From www.youtube.com

Statute Of Limitations On Student Loan Debt Federal vs. Private Loans Loan Statute Of Limitations By State if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. In others, it’s up to 10. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. a collector only has a certain. Loan Statute Of Limitations By State.

From www.lexingtonlaw.com

Statute of limitations on debt collection by state Lexington Law Loan Statute Of Limitations By State in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. if you’re getting calls from debt collectors about. Loan Statute Of Limitations By State.

From www.creditrepair.com

What is the Florida statute of limitations on debt and collection laws Loan Statute Of Limitations By State a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. In others, it’s up to 10. each. Loan Statute Of Limitations By State.

From www.pinterest.com

Statutes of Limitations on Debt Collection by State Debt, Debt Loan Statute Of Limitations By State In others, it’s up to 10. in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. a collector only has a certain number. Loan Statute Of Limitations By State.

From www.credible.com

Statute of Limitations on Private Student Loans State Guide Credible Loan Statute Of Limitations By State The rules can vary greatly state to state. if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. 52 rows the federal trade commission notes that if you make a payment or agree to payment. In others, it’s up to 10. a collector. Loan Statute Of Limitations By State.

From www.credible.com

Statute of Limitations on Private Student Loans State Guide Loan Statute Of Limitations By State each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. In others, it’s up to 10. if you’re getting calls. Loan Statute Of Limitations By State.

From www.creditrepair.com

What is the Florida statute of limitations on debt and collection laws Loan Statute Of Limitations By State a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. in some states, the statute of limitations for credit card. Loan Statute Of Limitations By State.

From www.credible.com

Statute of Limitations on Private Student Loans State Guide Credible Loan Statute Of Limitations By State if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. a collector only has a certain number of years where. Loan Statute Of Limitations By State.

From thesuccessbug.com

What is the Statute of Limitations on Debt? Loan Statute Of Limitations By State each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. 52 rows the federal trade commission notes that if you make a payment. Loan Statute Of Limitations By State.

From www.slideteam.net

Loan Statute Limitations Ppt Powerpoint Presentation Summary Files Cpb Loan Statute Of Limitations By State in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. if you’re getting calls from debt collectors about old debt, by law, you. Loan Statute Of Limitations By State.

From www.pinterest.com

Statute of Limitations on Debt Collection by State Debt collection Loan Statute Of Limitations By State in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. 52 rows the federal trade commission notes that if you make a payment or agree to payment. if you’re getting calls from debt collectors about old debt, by law, you might not need to. Loan Statute Of Limitations By State.

From thecollegeinvestor.com

Student Loan Statute Of Limitations Timelines (By State) Loan Statute Of Limitations By State In others, it’s up to 10. in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations periods in years. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. The rules can vary greatly state to state.. Loan Statute Of Limitations By State.

From www.scribd.com

Case 8 ART. 1953 PDF Loans Statute Of Limitations Loan Statute Of Limitations By State each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. In others, it’s up to 10. 52 rows the federal trade commission notes that if you make a payment or agree to payment. if you’re getting calls from debt collectors about old debt, by law, you. Loan Statute Of Limitations By State.

From www.scribd.com

Republic V Grijaldo GR20240 PDF Loans Statute Of Limitations Loan Statute Of Limitations By State The rules can vary greatly state to state. if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. In others, it’s up to 10. in the table below, you’re able to examine a list of all 50 states with their respective statute of limitations. Loan Statute Of Limitations By State.

From www.youtube.com

Statute of Limitations for Credit Card Debt YouTube Loan Statute Of Limitations By State The rules can vary greatly state to state. 52 rows the federal trade commission notes that if you make a payment or agree to payment. if you’re getting calls from debt collectors about old debt, by law, you might not need to pay if the debt is too old. in the table below, you’re able to examine. Loan Statute Of Limitations By State.

From goldenfs.org

Statute of Limitations on Debt including credit card debt (in all 50 Loan Statute Of Limitations By State a collector only has a certain number of years where they can take you to court to force you to pay a debt that you owe. The rules can vary greatly state to state. each state has its own statute of limitations on debt, and they vary depending on the type of debt you have. In others, it’s. Loan Statute Of Limitations By State.

From www.scribd.com

REPUBLIC v. GRIJALDO PDF Loans Statute Of Limitations Loan Statute Of Limitations By State in some states, the statute of limitations for credit card debt is three years. The rules can vary greatly state to state. 52 rows the federal trade commission notes that if you make a payment or agree to payment. each state has its own statute of limitations on debt, and they vary depending on the type of. Loan Statute Of Limitations By State.